|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Company to Refinance Home With: A Comprehensive GuideChoosing the best company to refinance your home can be a daunting task. With numerous lenders offering various terms and rates, it is crucial to make an informed decision. This article explores the key considerations and top companies to consider when refinancing your home. Understanding RefinancingWhat is Refinancing?Refinancing involves replacing your existing mortgage with a new one, typically to secure better terms or lower interest rates. Benefits of Refinancing

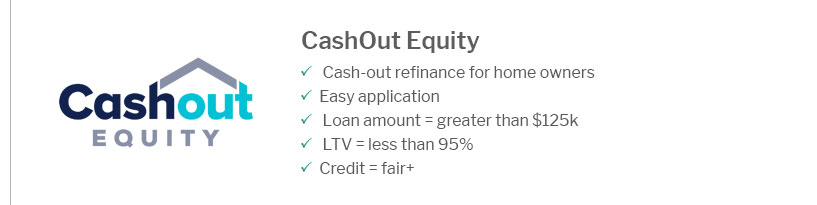

Top Companies for Home RefinancingQuicken LoansKnown for its excellent customer service and fast processing, Quicken Loans is a top choice for many homeowners. LoanDepotLoanDepot offers a variety of refinancing options, making it a flexible choice for different financial situations. Better MortgageBetter Mortgage is recognized for its transparent pricing and no commission fees. Important ConsiderationsEvaluating Lender ReputationResearch each lender's reputation by reading reviews and checking their standing with the Better Business Bureau. Comparing Loan OffersAlways compare loan estimates from multiple lenders to ensure you are getting the best deal. Consider using online platforms like refinance take equity out to compare offers easily. Calculating the CostsConsider all the costs associated with refinancing, including closing costs, to determine if it is financially beneficial. FAQs About Refinancing

https://www.consumeraffairs.com/finance/finance__companies.htm

Looking for the best mortgage lender? Our top picks include New American Funding, Cardinal Financial, AmeriSave and Rocket. https://themortgagereports.com/69718/best-refinance-rates-top-lender-rankings

Which bank is best for refinancing? Based on our lender data, JPMorgan Chase Bank offers the best refinance rates overall. However, the best ... https://www.navyfederal.org/loans-cards/mortgage/refinancing.html

Refinance Your Mortgage and Save. Depending on the terms of your current loan and how long you plan to stay in your home, refinancing could be the best ...

|

|---|